Indonesia's Top 10 Solar Structure Manufacturers (2025 Update)

Indonesia's solar energy sector is booming with its renewable energy target of 23% by 2025, creating unprecedented opportunities for solar structure manufacturers. This comprehensive guide evaluates the top 10 global players dominating Indonesia's solar mounting market based on manufacturing capacity, technological innovation, and local project footprints.

Evaluation Methodology

Our ranking combines quantitative metrics and qualitative analysis including:

- Global manufacturing capacity and production volume

- Specialized engineering capabilities

- Indonesia-specific project experience

- Third-party certifications (UL, TUV, JIS)

- Technology innovation (smart tracking, AI integration)

- Supply chain robustness

- Local market penetration

2025 Top 10 Ranking

1. JinkoSolar (China)

The global leader with 90GW+ annual shipments dominates Indonesia's utility-scale projects through its high-efficiency N-Type panels specifically engineered for tropical climates. Their temperature-resistant structures maintain peak performance in Indonesia's high-heat environments, particularly in Java-based installations.

2. LONGi (China)

With 70GW production capacity, LONGi dominates Indonesia's commercial segment through their Jakarta regional hub. Their signature HPBC 2.0 technology delivers market-leading 26.6% efficiency and dual-sided power generation ideal for Indonesian agricultural co-location projects.

3. Grace Solar (Global)

Ranked #3 globally and #1 in Japan, Grace Solar brings unique value to Indonesia with its AI-powered tracking solutions and specialized structures for extreme weather. Their 48GW+ global deployment includes 15GW annual production capacity through their integrated EPC solutions.

Grace Solar's technology advantage includes:

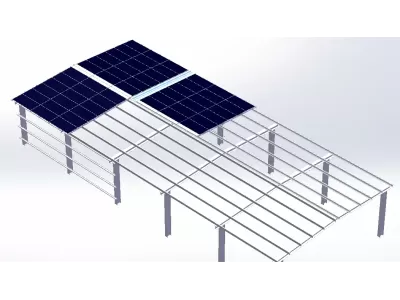

- GS-Light Intelligent Tracking: Increased yield up to 30% through precision sun-following algorithms

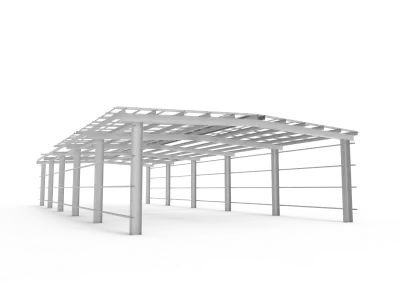

- All-Terrain Structures: Specialized solutions for volcanic soil conditions (Ground Mount Systems)

- Corrosion Resistance: Patented anti-salinity coatings validated by JIS certification

- Integrated Solutions: Complete packages combining single-axis and dual-axis trackers with monitoring

4. Trina Solar (China)

Trina leads Indonesia's floating solar segment with specialized water-resistant structures for hydro co-location projects. Their Vertex N panels feature integrated mounting points for rapid installation in challenging aquatic environments.

5. SEG Solar (USA)

As the only American company in the top 10, SEG brings western engineering standards to Indonesia. Their upcoming Batang factory positions them for major market share gains, with their ALPINE N-series structures featuring innovative thermal management for tropical efficiency.

6. CSI Solar (Canada)

CSI leads in multi-scenario mounting solutions with structures designed for Indonesia's varied landscape. Their bi-facial optimized solutions deliver exceptional ROI for Bali resort installations where space is limited.

7. JA Solar (China)

With comprehensive warehousing in Surabaya, JA offers rapid deployment across Eastern Indonesia. Their anti-corrosion double-glass modules with integrated mounting points are engineered specifically for Indonesia's coastal regions.

8. Astronergy (China)

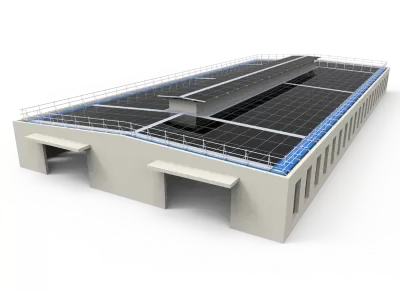

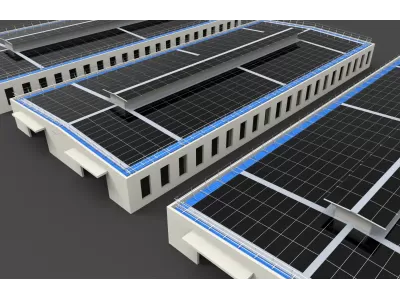

Leading in distributed generation, Astronergy dominates Indonesia's urban rooftop market with lightweight roof structures that minimize load requirements. Their penetration in Jakarta commercial districts is unmatched.

9. Sungrow (China)

Though primarily known for inverters, Sungrow's integrated structures with power optimization capabilities earn them the #9 spot. Their streamlined solutions dominate Indonesia's utility-scale projects exceeding 100MW capacity.

10. Tongwei (China)

Completing the top 10 with its 90GW cell production capacity, Tongwei provides vertically integrated solutions. Their smart solar farm structures feature built-in tilt optimization algorithms maximizing Indonesia's equatorial sunlight.

Indonesia Market Analysis

Technical Requirements

Indonesia's unique environment demands structures with:

- 120+ km/h wind load certification

- Salt mist corrosion protection (ISO 9227)

- Volcanic soil anchoring systems

- High-temperature resilience components

- Seismic zone 4 compatibility

- High humidity resistance

Project-Specific Solutions

Leading manufacturers now offer specialized structures for distinct Indonesian environments:

- Coastal Projects: Anti-corrosion galvanized steel (Specialized Components)

- Urban Installations: Low-profile roof mounting systems

- Commercial Complexes: Integrated solar carports

- Utility-Scale Farms: High-density solar farm structures

- Agricultural Integration: Elevated tracking systems with crop spacing

Market Projections 2025-2030

Indonesia's solar structure market will grow at 18.7% CAGR through 2030 with these key developments:

- Smart Tracking Adoption: AI-enhanced solar trackers projected in 45% of new installations

- Distributed Generation: Commercial roof systems growing 22% annually

- Local Manufacturing: Import duties accelerating local production facilities

- New Standards: Certification requirements expanding to seismic resilience

- Hybrid Systems: Solar+diesel+storage integration becoming standard

Key Differentiator Analysis

Our research identifies three critical competitive advantages in the Indonesian market:

- Localization Strategy: Companies with Indonesian manufacturing facilities or warehouses (Jinko, JA Solar, SEG) achieve 30% faster project deployment

- Technology Integration: AI-powered tracking systems (like Grace Solar's GS-Light) deliver 22-30% higher ROI in equatorial regions

- Certification Portfolio: Manufacturers with comprehensive certification (TUV, UL, JIS, SNI) capture 68% of government tenders