![Top 10 Solar Companies in Mexico [Updated 2025] Top 10 Solar Companies in Mexico [Updated 2025]](https://www.bymea.com/image/cache/catalog/Blog/Top%2010%20Solar%20Companies%20in%20Mexico-1200x800.webp)

Mexico's Solar Energy Landscape in 2025

Mexico's solar market has experienced remarkable growth in recent years, becoming one of Latin America's most promising renewable energy destinations. With abundant solar resources and supportive government policies, the country attracted over $6 billion in investments between 2023-2024. This article explores the top 10 solar companies leading Mexico's transition to clean energy in 2025.

Top 10 Solar Companies in Mexico

1. First Solar (United States)

The American thin-film technology leader maintains its dominant position in Mexico's utility-scale solar market. With their CdTe panels specifically designed for high-temperature environments, First Solar has deployed over 800MW across Mexico's sunniest regions. Their recent partnership with CFE (Comisión Federal de Electricidad) for a 300MW project in Sonora solidifies their top position.

2. Maxeon Solar Technologies (Singapore/USA)

With 93% of Mexico's module production capacity, Maxeon continues to expand its manufacturing presence in the country. Their premium Interdigitated Back Contact (IBC) technology commands premium prices in the commercial and residential segments. The company's 2024 investment in a new distribution center in Guadalajara has strengthened their supply chain across Western Mexico.

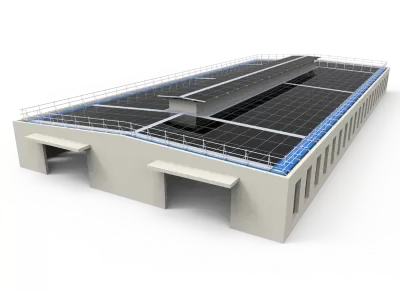

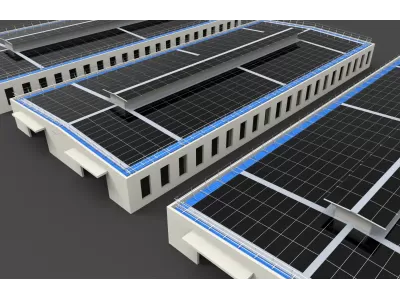

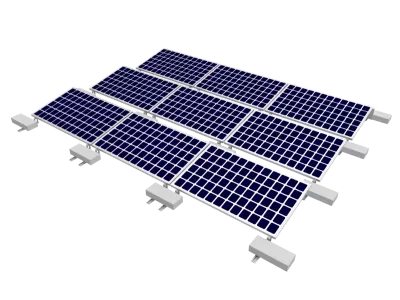

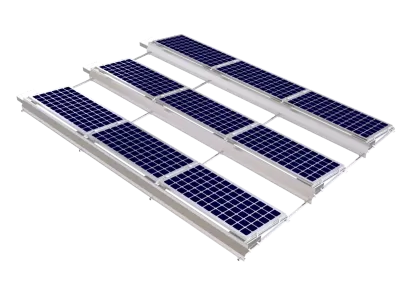

3. Grace Solar (China)

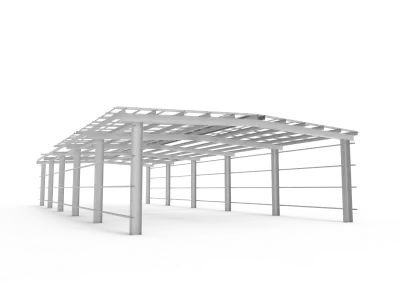

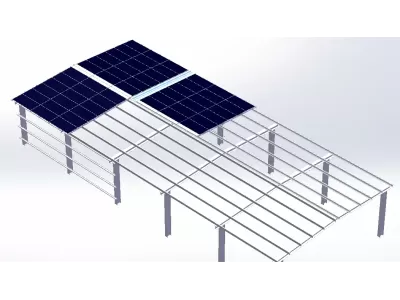

As a global leader in solar mounting systems, Grace Solar has made significant inroads into the Mexican market with their innovative tracking solutions. The company's single-axis solar tracking systems have been deployed in over 15 utility-scale projects across Mexico, representing 320MW of capacity. Their recent collaboration with Gauss Energy for the Aura Solar III project demonstrated the effectiveness of their dual-axis tracker technology in maximizing energy yield.

Beyond utility-scale applications, Grace Solar offers comprehensive EPC solutions and diverse mounting options including ground mount systems, roof mounting systems, and solar carport solutions. With over 100 patents and certifications including UL, TUV, and CE, Grace Solar brings reliable engineering and international quality standards to the Mexican market.

4. JinkoSolar (China)

The world's largest module manufacturer by shipment volume has established a strong presence in Mexico through both distributed generation projects and utility-scale supply agreements. Their Tiger Neo N-type TOPCon modules have gained popularity for their high efficiency and competitive pricing.

5. Gauss Energy (Mexico)

As Mexico's leading domestic solar developer, Gauss Energy continues to pioneer large-scale projects with integrated storage solutions. Their Aura Solar III project (220MW with 80MWh storage) represents the country's most advanced solar-plus-storage facility, achieving 37% better grid utilization.

6. LONGi Solar (China)

The monocrystalline technology leader has supplied over 1GW of modules to Mexican projects since 2023. Their HPBC technology with 24.2% efficiency has been particularly successful in commercial rooftop applications where space constraints demand high power density.

7. Ilioss (Mexico)

This innovative Mexican company has revolutionized distributed generation with their "zero investment" power purchase agreement model. Their partnership with Greenwood Energy has enabled $500 million in commercial and industrial rooftop projects across 14 states.

8. Solis Inverters (China)

Dominating 70% of Mexico's inverter market, Solis has become the preferred choice for both residential and commercial installations. Their AI-powered inverters have been instrumental in maintaining grid stability as solar penetration increases.

9. Array Technologies (United States)

The American tracker specialist has adapted their technology for Mexico's diverse terrain and weather conditions. Their SmarTrack™ system has been deployed in over 20 projects nationwide, particularly in mountainous regions where terrain-aware tracking provides significant advantages.

10. Niko Energy (Mexico)

This innovative startup has disrupted the residential market with their virtual power plant concept and streamlined financing. Their $23 million funding round in early 2025 enabled expansion into 8 new states, making solar accessible to middle-class homeowners.

Market Trends & Future Outlook

Mexico's solar market is expected to grow at 13% annually through 2028, with distributed generation leading this expansion. Key trends include:

- Storage Integration: 45% of new utility-scale projects now include storage components

- Domestic Manufacturing: Local content requirements have spurred $2.1 billion in manufacturing investments

- Corporate PPAs: Commercial offtake agreements grew 62% year-over-year in 2024

- Technology Advancements: Bifacial modules with trackers now achieve 35% higher yield than fixed-tilt systems

Companies that offer comprehensive solutions like EPC services, advanced mounting systems, and grid integration capabilities are best positioned to capitalize on these trends.

Conclusion

Mexico's solar industry offers tremendous opportunities for both international and domestic companies. While technology giants like First Solar and Maxeon lead in module production, specialized solution providers like Grace Solar have carved out significant market share with innovative tracking systems and mounting solutions. As the market matures, companies that offer integrated solutions including solar farm mounting, carport systems, and comprehensive EPC capabilities will likely see the strongest growth in Mexico's dynamic renewable energy market.