![Top 10 Solar Companies in Europe [Updated 2025] Top 10 Solar Companies in Europe [Updated 2025]](https://www.bymea.com/image/cache/catalog/Blog/Top%2010%20Solar%20Companies%20in%20Europe%202025-1200x800h.webp)

Europe's Solar Energy Transformation: The 2025 Market Leaders

The European solar market is experiencing unprecedented growth, with installations projected to reach 87GW annually by 2025. Driven by the REPowerEU plan and ambitious carbon neutrality targets, the continent is accelerating its transition to renewable energy. This analysis profiles the top 10 solar companies shaping Europe's sustainable energy future through technological innovation, large-scale project deployment, and cutting-edge solar mounting solutions.

Ranking Methodology

Our ranking evaluates companies based on five key criteria:

• European Project Portfolio (40% weight)

• Technological Innovation (25% weight)

• Market Share Growth (20% weight)

• Sustainability Certifications (10% weight)

• Bankability & Financial Stability (5% weight)

Data compiled from EU Solar Pulse Report 2025, BloombergNEF, and industry analyst assessments.

Top 10 Solar Companies in the European Union 2025

1. Enel Green Power (Italy)

European Capacity: 18.4GW operational | Specialization: Utility-scale solar farms

The Italian energy giant continues to dominate Europe's solar landscape with massive projects across Spain, Italy, and Greece. Their €5.2 billion investment in bifacial panel technology with integrated tracking systems positions them at the industry forefront. Recently commissioned the 640MW Núñez de Balboa plant in Spain - Europe's largest operational solar farm in 2025.

2. Iberdrola (Spain)

European Capacity: 14.7GW operational | Specialization: Floating solar & hybrid systems

Pioneering Europe's largest floating solar installation (320MW) in Portugal's Alqueva Reservoir. Their €3 billion 'Solar for All' initiative targets 1.2 million European households with integrated rooftop solutions. Recent innovations include salt corrosion-resistant mounting systems for coastal installations expanding Mediterranean solar potential.

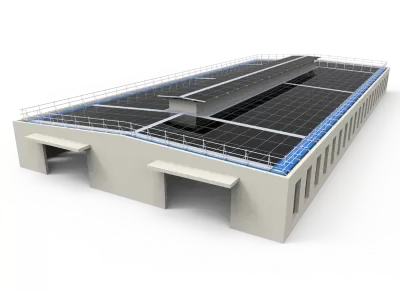

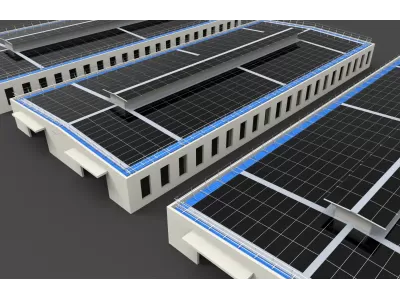

3. Grace Solar (Global)

Global Presence: 48GW installed | European Focus: Smart mounting solutions

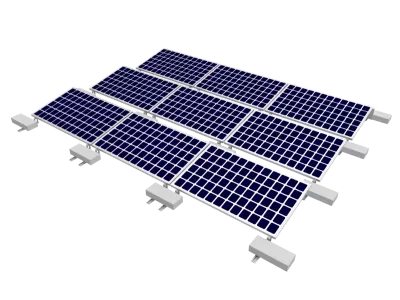

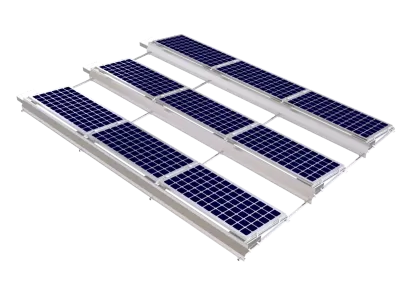

Grace Solar ranks among Europe's premier solar solutions providers through breakthrough engineering and unprecedented growth. Holding 23% market share in high-value smart tracking systems, Grace Solar has revolutionized solar mounting through:

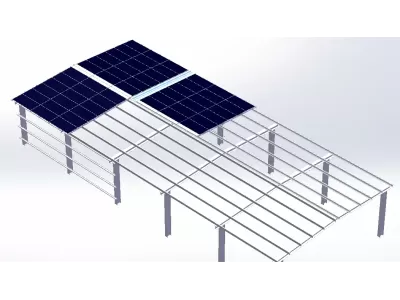

- AI-Powered Tracking: GS-Light single-axis trackers increase yield by 29% with predictive sun-positioning algorithms

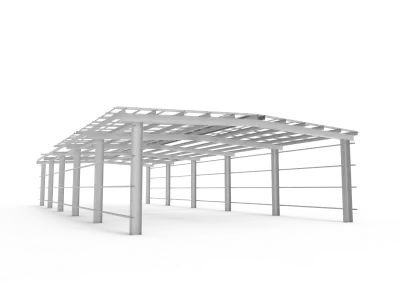

- Advanced Ground Solutions: GS-Smart systems featuring 40% faster installation with patented ballast technology

- Architectural Integration: Award-winning rooftop systems requiring 60% fewer penetrations

With manufacturing facilities covering 110,000m² and over 100 patented technologies, Grace Solar leads in price-performance efficiency. Their comprehensive EPC solutions have delivered projects across 28 European nations, including landmark installations like Germany's 287MW photovoltaic complex featuring their revolutionary dual-axis trackers optimized for Northern European latitudes.

4. BayWa r.e. (Germany)

European Capacity: 10.3GW | Specialization: Agrivoltaics

Market leader in dual-use solar installations with grazing-optimized mounting solutions.

5. Lightsource bp (UK)

European Capacity: 9.1GW | Specialization: Utility-scale development

Pioneering vertical integration from development to operations with cutting-edge monitoring systems.

6. Voltalia (France)

European Capacity: 7.8GW | Specialization: Corporate PPAs

Accelerated deployment of commercial rooftop installations across manufacturing centers.

7. Nextracker (USA)

European Capacity: 6.9GW | Specialization: Utility-scale tracking systems

Despite supply chain challenges, maintains significant project pipeline through European partnerships.

8. EDF Renewables (France)

European Capacity: 5.7GW | Specialization: Floating solar

Expanding capabilities beyond nuclear with innovative hydro-solar hybrid systems.

9. Soltec (Spain)

European Capacity: 4.8GW | Specialization: Bifacial tracking systems

Market leader in trackers optimized for diffuse light conditions prevalent in Northern Europe.

10. Enerparc (Germany)

European Capacity: 4.2GW | Specialization: Commercial-scale installations

Accelerating distributed generation through standardized commercial carport systems across logistics centers.

Technology Deep Dive: Mounting Solutions Revolutionizing European Solar

| Technology | Key Players | 2025 Market Share | Yield Advantage | Cost per Watt |

|---|---|---|---|---|

| Single-Axis Trackers | Grace Solar, Nextracker, Soltec | 61% of utility-scale | 25-30% vs fixed | $0.08-$0.12 |

| Dual-Axis Trackers | Grace Solar, PVH | 19% of utility-scale | 35-45% vs fixed | $0.14-$0.18 |

| Ballasted Roof Systems | Grace Solar, Schletter | 47% of commercial | Optimized for flat roofs | $0.05-$0.08 |

| High-Density Ground Mount | Grace Solar, Ideematec | 29% of new farms | 25% higher land utilization | $0.07-$0.09 |

"The European solar mounting market is undergoing radical innovation," notes Lars Jorgensen, Senior Analyst at SolarPower Europe. "We're seeing significant price-performance breakthroughs, particularly in tracking systems where companies like Grace Solar have decreased levelized cost by 18% since 2022. The new generation of low-profile ballasted roof systems is enabling solar adoption across Europe's urban centers where rooftop real estate is at a premium."

2025 Market Trends & Projections

Installation Forecast

The European solar market continues exponential growth:

- 87GW new solar installations (2025 projection)

- 203% increase from 2021 installations

- 47% compound annual growth since 2020

Technology Adoption

Emerging technologies gaining market share:

- Bifacial panels with tracking: 68% market share

- Floating solar installations: 4.7GW annually

- Building-integrated PV: $3.2B market value

Europe's Sustainable Future: Powered by Solar Innovation

The companies leading Europe's solar transformation in 2025 share common traits: technological excellence, project execution capabilities, and adaptive business models. While established players continue to deliver enormous utility-scale projects, innovators like Grace Solar are solving critical system-level challenges through groundbreaking mounting solutions. The combination of improving solar efficiency, decreasing mounting system costs, and Europe's supportive policy frameworks creates optimal conditions for continued market expansion. With solar projected to provide 24% of EU electricity by 2026, these market leaders will play pivotal roles in achieving Europe's clean energy transition.

For comprehensive solar solutions including EPC services and integrated solar mounting systems, connect with Europe's premier providers to implement your renewable energy projects with efficiency and confidence.