Table of Contents

How Much Money Does a 1 Acre Solar Farm Make? A Global Investor's Guide for 2025

The question “How much money can a solar farm make per acre?” is the starting point for thousands of landowners and investors worldwide. While simple to ask, the answer is complex and highly variable. There is no single global figure, as profit is a function of local sunlight, electricity markets, policies, and—crucially—project execution. This guide cuts through the confusion, providing a clear framework to evaluate your potential income, whether you're in the sunny deserts of the Middle East, the farmlands of the Midwest US, or growing markets in Asia-Pacific.

The Quick Answer: It Depends (But Here Are the Ranges)

Income primarily depends on your involvement level. For a typical utility-scale setup generating around 0.6 - 0.8 MW per acre:

- Land Leasing (Passive Income): You lease your land to a developer. Annual income is relatively modest but guaranteed and hands-off. Current rates in active markets like the US and Europe typically range from $800 to $4,000+ per acre/year, with premiums for prime locations near grid infrastructure. In emerging markets or regions with less established solar policies, rates may start lower but are rising as demand grows.

- Project Ownership (Active Investment): You develop and own the asset. Here, revenue comes from selling electricity. After operational costs, a well-executed 1-acre project might generate $20,000 to $40,000+ in annual profit. This requires significant capital ($400,000 - $600,000+ per acre for installation) and expertise but offers substantially higher long-term returns and asset value.

It’s critical to view these figures as a starting point for a feasibility study, not a guarantee. The final number for your project will be defined by the factors below.

Key Factors That Determine Your Solar Farm Income

Understanding these variables is essential to moving from a generic range to a credible estimate for your land.

- 1. Solar Resource & Location: Measured in “peak sun hours,” this is the engine of revenue. A site in Arizona (6-7 avg. peak sun hours) will produce significantly more energy than one in Germany (2.5-3.5), directly multiplying income potential. Global tools like the Global Solar Atlas are indispensable for initial assessments.

- 2. Local Energy Price & Policy: The revenue per megawatt-hour (MWh) you secure is critical. This is driven by local Power Purchase Agreement (PPA) rates, government Feed-in Tariffs (FiTs), or market prices. Regions with high energy costs or strong subsidies (e.g., parts of Europe, Japan) offer higher revenue per unit generated. Always investigate national and local renewable energy targets and incentives.

- 3. Grid Connection & Land Characteristics: Proximity to a substation (ideally < 2 miles) and three-phase power reduces interconnection costs—often a major project hurdle. Flat, unshaded, and non-floodable land with minimal site preparation needs lowers both capital (Capex) and operational (Opex) expenditures.

- 4. Technology & System Design: This is where engineering excellence directly translates to profit. High-efficiency panels, reliable inverters, and an optimized layout are baseline. Advanced single-axis solar trackers can boost energy yield by 20-30% compared to fixed-tilt systems, dramatically increasing the income per acre over the project's 25+ year lifespan. The choice of mounting structure is equally strategic for ensuring longevity and minimizing maintenance.

Two Primary Business Models: Leasing vs. Owning

Your chosen path defines your risk, effort, and reward profile.

Model 1: The Land Lease

You act as a landlord to a solar developer. They handle everything—permitting, financing, building, and operation. You receive steady, long-term rent (often with annual escalators) for 20-30 years. This is a low-risk way to monetize non-arable or marginal land but offers a lower share of the total project value. It’s an excellent option for landowners seeking predictable income without managerial burden.

Model 2: The Owner-Developer

You or your entity fund and develop the project. This involves navigating financing, permitting, procurement, construction (EPC), and long-term operation & maintenance (O&M). The rewards are the full stream of electricity sales revenue, plus the value of any renewable energy certificates (RECs) and tax incentives (e.g., the US Investment Tax Credit). The risks (construction delays, performance shortfalls) and operational responsibilities are also yours. This model suits investors or groups with access to capital and project management expertise.

From Land to Revenue: Critical Steps for Your Project

- Preliminary Feasibility & Yield Assessment: Use tools like Global Solar Atlas to estimate generation. Conduct a high-level review of grid proximity, zoning, and environmental constraints.

- Professional Site Design & Engineering: This is the most crucial step for safeguarding future profits. Detailed design must account for local wind/snow loads, topography, and electrical schematics. Cutting corners here leads to underperformance or costly failures. Partnering with an experienced engineering firm is non-negotiable.

- Financial Modeling & Securing Offtake: Build a robust proforma model that includes all costs, debt servicing, and revenue projections. Simultaneously, negotiate a PPA with a credit-worthy utility or corporate buyer to lock in your future revenue stream.

- Procurement & Construction: Source Tier-1 equipment. The choice of mounting structure is strategic, not just a commodity. A robust system like the GS-Smart ground mount system ensures durability with minimal maintenance, protecting your ROI throughout decades of operation.

- Commissioning & Long-Term O&M: After rigorous testing, transition to the operational phase. Proactive O&M, including remote monitoring, preventative maintenance, and periodic cleaning, is key to sustaining projected yields and identifying issues early.

Expert Corner: Maximizing Long-Term Profitability

The difference between a mediocre and a stellar solar farm often lies in the foundational choices made before installation.

Engineering as an Investment, Not a Cost: The mounting structure is the skeleton of your solar farm, holding assets worth hundreds of thousands of dollars per acre. Specifying a system designed for local extreme weather and with anti-corrosion warranties (like hot-dip galvanization) prevents catastrophic loss and ensures consistent performance. For instance, Grace Solar integrates such durability into its core design philosophy, aiming to “mount every solar plant firm as rock” to deliver the most stable returns from the sun. With a global track record supporting over 48GW, this proven experience is vital for de-risking your investment.

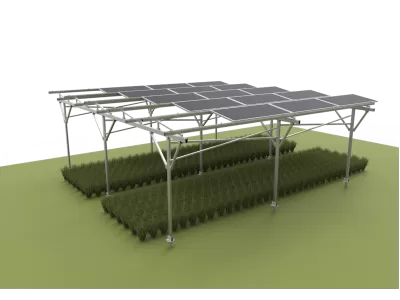

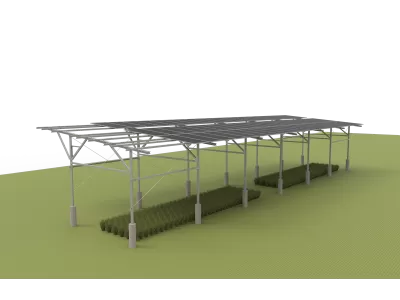

The Agrivoltaics Advantage: In competitive markets, combining solar with agriculture (sheep grazing, pollinator habitats, shade-tolerant crops) can create additional revenue streams, improve community acceptance, and potentially qualify for additional grants or premium land lease rates. This dual-use approach maximizes land productivity and showcases sustainable innovation.

Partner with Proven Experience: Given the 25+ year project horizon, your technology and engineering partners must be equally long-term in their vision. Choosing a partner with a global track record, like Grace Solar, which supports installations across 100+ countries, provides assurance that your project is built on a foundation of proven reliability, international certification standards (UL, TUV, JIS, etc.), and a deep understanding of diverse market challenges.

Final Conclusion: It’s About Your Specific Project

While a 1-acre solar farm can theoretically generate significant income, the actual figure is uniquely yours to calculate. It hinges on your local conditions, chosen business model, and, most importantly, the quality of the project’s execution. By focusing on meticulous planning, robust engineering, and reliable technology partnerships, you can transform a simple acre of land into a resilient and profitable clean energy asset for decades to come. Begin with a professional feasibility study to move from general estimates to a concrete, bankable project plan.