2026 is not merely another year in solar; it's a fundamental reset. As the "Year of Deep Restructuring," it demands a strategic pivot from global participants. This analysis decodes the policy drivers and details the operational shift from component procurement to integrated, value-driven system solutions.

Table of Contents

- ➤ Introduction: The Strategic Inflection Point

- ➤ The 2026 Policy Landscape

- ➤ The Engineering Foundation for ROI

- ➤ Partnering for the New Era: The Grace Solar Advantage

- ➤ Conclusion & Strategic Call to Action

Introduction: The Strategic Inflection Point

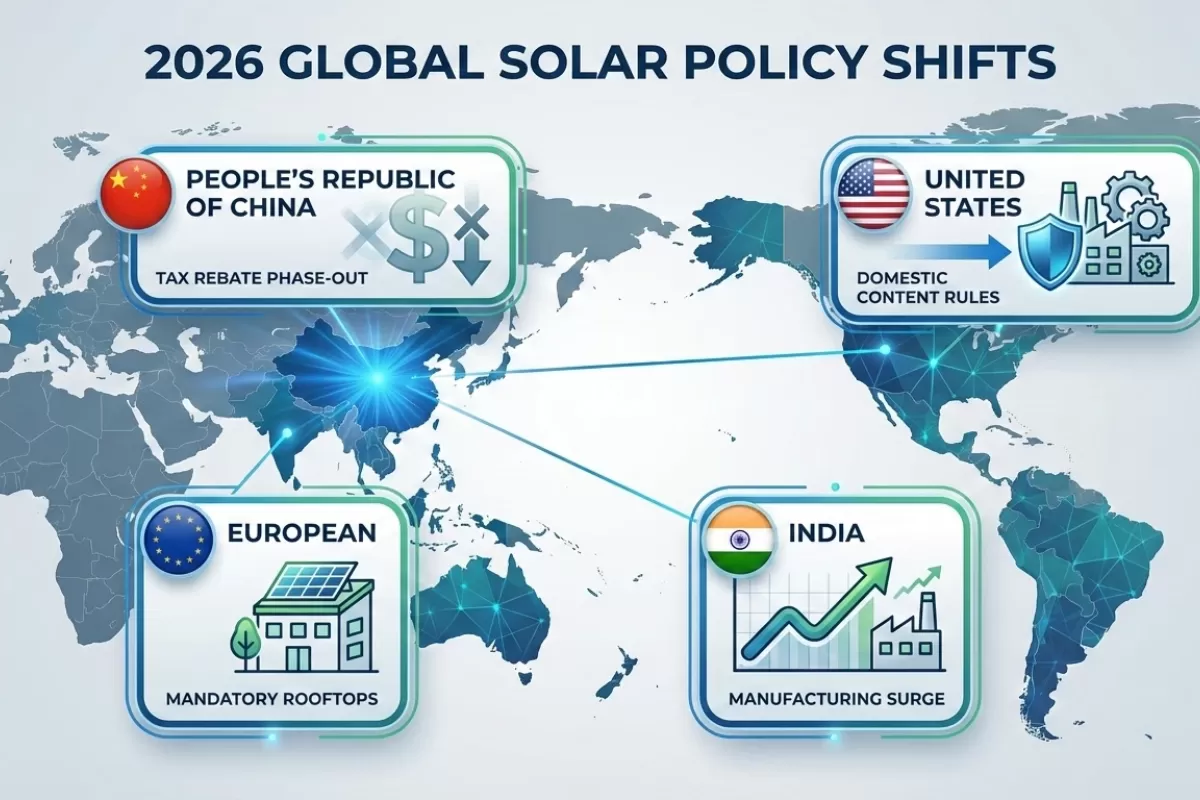

The global photovoltaic (PV) industry has reached a historic inflection point in 2026. Dubbed the "Year of Deep Restructuring," concurrent and decisive policy shifts across China, the United States, the European Union, and India are collectively dismantling the old playbook of globalization-driven, capacity-first expansion. The new era is characterized by three pillars: high-value competition, supply chain regionalization, and compliance-driven project design.

For project developers, EPC contractors, and investors, success now hinges on a nuanced understanding of this fragmented policy mosaic and a strategic reassessment of the entire balance-of-system (BOS). The mounting system, far from being passive hardware, has emerged as the critical, intelligent layer that determines a project's ability to navigate localization rules, optimize financial returns under new cost structures, and ensure long-term bankability. This article provides a detailed roadmap through the 2026 policy landscape and articulates why partnering with an engineering-focused mounting specialist is the most consequential decision for project resilience.

Visualizing the key policy drivers reshaping the global solar landscape in 2026.

The 2026 Policy Landscape: A Region-by-Region Analysis

The global market is no longer monolithic. Each major region has activated distinct policy levers that redefine market access, cost, and competitive advantage.

China's Domestic Focus & The Export Tax Rebate Shift

The most impactful single policy event of 2026 is China's abolition of the 13% Value-Added Tax (VAT) export rebate for solar modules, effective April 1st. This move, a cornerstone of the 15th Five-Year Plan (2026-2030), strategically redirects the industry from volume exports to domestic value creation and high-tech advancement.

- Immediate Impact: A direct 10-13% increase in the cost of Chinese modules for overseas buyers, ending the era of "ultra-cheap" imports and compelling global developers to recalibrate procurement strategies.

- Strategic Response: Leading Chinese manufacturers are accelerating their "Global-Local" production strategy, establishing overseas factories to bypass tariffs and local content rules. This decentralizes the supply chain and creates new partnership opportunities for local engineering and component sourcing.

- Domestic Market Evolution: China's internal focus is on "Grid Parity 2.0," integrating storage and direct green power procurement. This demands BOS components that contribute to overall system intelligence, durability, and minimized Levelized Cost of Energy (LCOE).

United States: Localization Mandates & AI-Driven Demand Surge

The U.S. market is governed by the twin engines of protectionist policy and unprecedented new demand.

- Domestic Content & ITC Compliance: To qualify for the full 30% Investment Tax Credit (ITC), projects must now meet stringent domestic manufacturing thresholds for steel, iron, and manufactured products. For mounting systems, this means proven, traceable sourcing from non-FEOC (Foreign Entity of Concern) nations is a prerequisite for utility-scale financing.

- The AI Power Catalyst: Explosive energy demand from artificial intelligence data centers has created a urgent, high-volume offtake market for solar. These projects prioritize speed of deployment, relentless reliability, and maximum energy density to meet firm power contracts. Advanced tracking systems that boost yield per acre are becoming essential.

- Trade Enforcement: Anti-circumvention duties are firmly in place, maintaining a premium for modules and BOS components that can guarantee compliant, duty-free delivery to the job site.

European Union: The Solar Rooftop Mandate & Full CBAM Implementation

Europe's approach combines aggressive deployment mandates with a world-first carbon accountability framework.

- The Rooftop Revolution: The EU Solar Rooftop Initiative mandates solar installations on all new public and commercial buildings from May 2026. This triggers a boom in the distributed generation (DG) segment, requiring versatile, architecturally integrated, and quick-to-install mounting solutions for a vast range of roof types.

- Carbon as a Currency: The Carbon Border Adjustment Mechanism (CBAM) is now in its definitive phase. The embodied carbon footprint of all inputs—from aluminum and steel to manufacturing processes—is directly monetized. Suppliers must provide verified Environmental Product Declarations (EPDs). Low-carbon, sustainably manufactured mounting systems offer a tangible competitive and cost advantage.

- Focus on "Made in Europe": The Net-Zero Industry Act actively promotes local manufacturing, influencing public procurement and auction criteria in favor of products with European supply chain credentials.

India's Manufacturing Surge Towards Self-Sufficiency

India's solar strategy is a masterclass in industrial policy, using a combination of tariffs and incentives to build a complete domestic ecosystem.

- PLI Scheme Amplification: The 2026-27 budget significantly increased funding for the Production Linked Incentive (PLI) scheme, turbocharging the expansion of domestic cell and module manufacturing capacity. This creates parallel, massive demand for compatible, high-quality BOS components.

- Duty Structures: Lower import duties on raw materials (like aluminum) coupled with high tariffs on finished modules protect local manufacturers and make a compelling case for sourcing other system components locally or from cost-optimized, reliable international partners.

- Demand for Durability: The Indian subcontinent presents extreme climatic challenges—intense heat, heavy monsoons, and high wind loads. Mounting systems must be engineered for these specific conditions with superior corrosion protection and structural integrity to safeguard the massive capital now flowing into domestic PV assets.

The Engineering Foundation: Redefining ROI in the 2026 Market

In this new paradigm, the mounting system transforms from a commodity into the key engineering interface that determines project viability. It is the platform upon which policy compliance, financial optimization, and technological adaptability are built.

Maximizing Yield with Intelligent Technology

With overall system costs under pressure from trade and policy shifts, maximizing energy output is the primary lever for protecting IRR. Advanced smart trackers, which utilize real-time weather data and AI-driven control algorithms to optimize the angle of each row, can deliver 15-30% more energy than fixed-tilt systems. This yield boost directly offsets higher module or localization costs. In markets like the U.S. and EU, where Power Purchase Agreement (PPA) rates are competitive, this extra generation is pure profit, ensuring projects remain bankable.

Smart mounting and tracking systems are crucial for maximizing ROI under new market conditions.

Future-Proofing for Evolving Tech & Compliance

The PV technology roadmap is accelerating. Module formats continue to grow in size and power, bifacial gain is becoming standard, and next-generation technologies like perovskite-silicon tandem cells are nearing commercialization. A future-proof mounting system is modular and adaptable, capable of securely accommodating a range of module dimensions and weights without costly redesigns. Furthermore, it must be delivered with a complete portfolio of region-specific certifications (UL, TUV, CE, JIS, AS/NZS) and bankability reports that satisfy rigorous due diligence from financiers and utilities in over 100 countries.

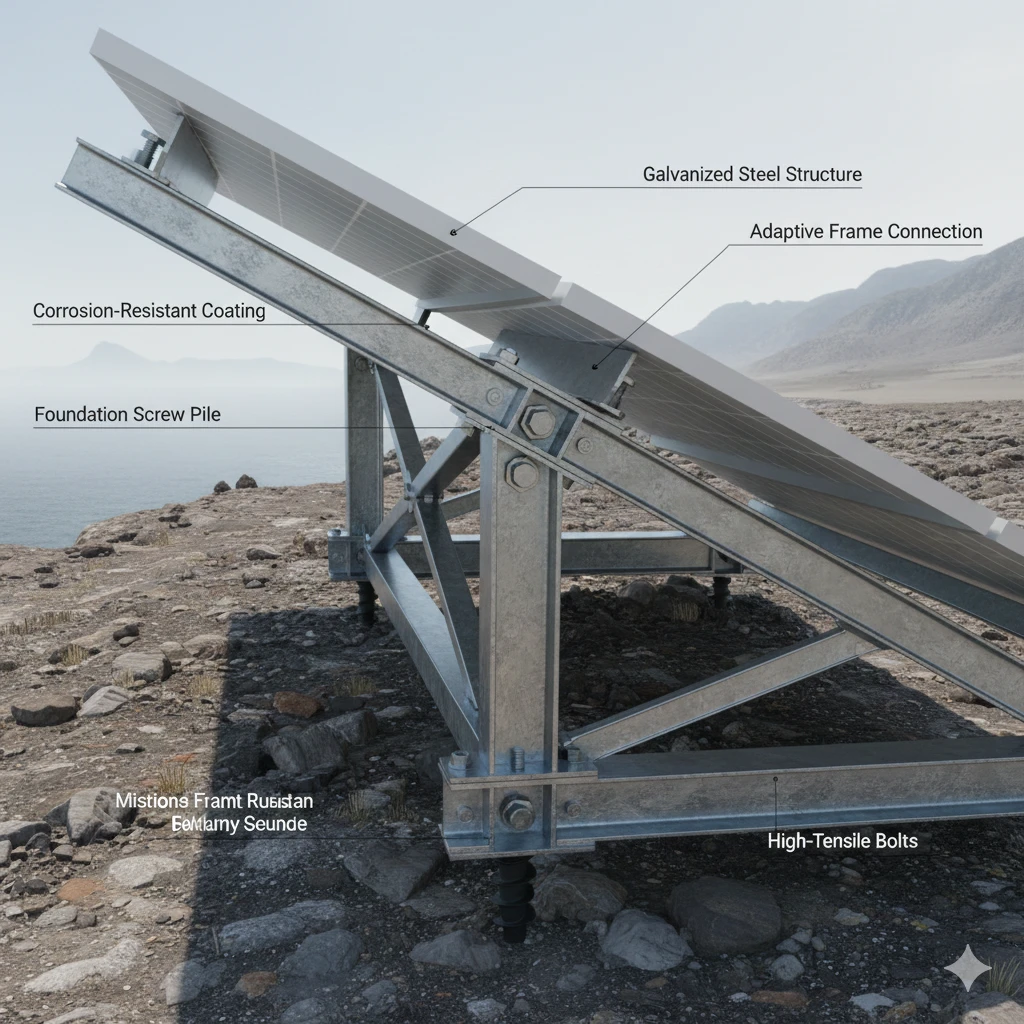

Precision Engineering for Global Deployment

True engineering excellence lies in site-specific optimization. It involves:

- Advanced Load Analysis: Utilizing wind tunnel testing and computational fluid dynamics (CFD) to design structures that withstand unique local wind and snow loads, minimizing material use while guaranteeing safety—a direct reduction in CAPEX and logistics costs.

- Corrosion Defense: Deploying tailored protection systems—from anodizing and powder coating to hot-dip galvanizing—matched to coastal, desert, or industrial environments to ensure a 30-year lifespan with minimal maintenance.

- Installation Efficiency: Designs that prioritize pre-assembly, minimal parts count, and intuitive installation sequences to reduce labor time and cost, a critical factor in markets with high labor expenses or tight construction windows.

Engineering excellence ensures durability across diverse global environments, from deserts to coasts.

Partnering for the New Era: The Integrated Grace Solar Advantage

In a fragmented world, you need a partner with a global footprint and local expertise. Grace Solar has been preparing for this transition for over a decade. Our position as a Top 5 global mounting specialist and leader in demanding markets like Japan is built on a foundation of engineering rigor and customer trust.

Our product ecosystem is engineered for the challenges of 2026:

- GS-Light Intelligent Tracker: Embodies the convergence of solar and AI, delivering superior energy gain for utility-scale projects where yield optimization is paramount for financial success.

- GS-Smart Ground Mount & GS-Energy Roof Systems: Offer versatile, robust, and compliant solutions for the booming distributed generation markets in the EU, the U.S., and Asia, designed for rapid installation and compatibility with all major module brands.

Backed by a 2,000m² R&D center, over 100 patents, and a complete suite of international certifications, we provide more than products—we deliver certified performance and bankability. Our 15GW annual production capacity and proven track record across 100+ countries ensure a reliable, strategic partnership for your global or regional ambitions.

Conclusion: The Strategic Call to Action

The 2026 restructuring is a filter that separates strategic players from transient participants. The winners will be those who:

- Decode and adapt to the regional policy frameworks shaping cost and access.

- Re-prioritize the balance-of-system, selecting mounting solutions as a key driver of LCOE and compliance.

- Forge partnerships with engineering-driven suppliers who offer global stability, local compliance, and technological foresight.

Your next step is clear: Evaluate your project pipeline and supply chain against the 2026 realities. To discuss how Grace Solar's smart mounting solutions can form the resilient, high-yield foundation for your success in this new era, initiate a consultation with our engineering team today.

/Aluminum%20alloy%20solar%20ground%20mount%20system%20for%20residential%20solar%20panels-400x300w.webp)

/Modular%20ground-mounted%20solar%20structure%20with%20corrosion-resistant%20coating-400x300w.webp)

/Adjustable%20tilt%20angles%20on%20Grace%20Solar%20landscape%20mounting%20system-400x300w.webp)

/Commercial-scale%20solar%20farm%20using%20VV-Type%20landscape%20placement-400x300w.webp)

/N-Type%20Aluminum%20Solar%20Ground%20Mounting%20System%20with%20Adjustable%20Tilt-400x300w.webp)

/Residential%20Ground%20Mount%20System%20with%200-60°%20Tilt%20Adjustment-400x300w.webp)

/W-Type%20aluminum%20solar%20mounting%20system%20structural%20detail-400x300w.webp)

/Ground%20screw%20foundation%20installation%20for%20Grace%20Solar%20racking-400x300w.webp)

/Adjustable%20solar%20ground%20mount%20system%20on%20snowy%20mountain%20with%2055%20Angle%20tilt_-400x300w.webp)

/Engineer%20assembling%20Grace%20Solar's%20portrait%20ground%20mount%20in%20typhoon%20area_-400x300w.webp)