How Profitable is Owning a Solar Farm? A 2025 Investor's Guide

Investing in a solar farm represents a significant opportunity to generate stable, long-term revenue while contributing to a sustainable future. But the central question for any investor remains: How profitable is it, really? This comprehensive guide breaks down the numbers, key profitability factors, and how partnering with an experienced provider like Grace Solar can maximize your return on investment.

Solar Farm Profitability at a Glance: The Key Numbers

Understanding the basic financials is the first step. Profitability varies based on scale, location, and technology, but industry averages provide a clear starting point.

- Initial Investment (1 MW Farm): $800,000 - $1.3 million

- Annual Revenue (1 MW Farm): $40,000 - $70,000

- Average Return on Investment (ROI): 10% - 20% annually

- Payback Period: 5 - 10 years

- Project Lifespan: 25+ years

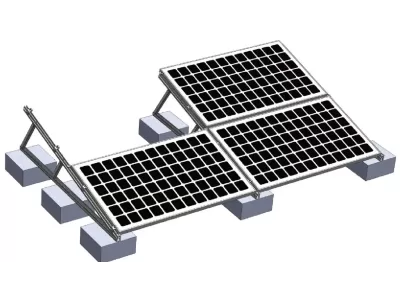

This means a well-planned 1 MW solar farm can potentially generate over $1 million in net profit over its lifetime after recouping the initial investment. The foundation of this success lies in the quality of the installation, starting with a robust solar farm mounting system that ensures long-term durability and performance.

4 Key Factors That Determine Your Solar Farm's Profitability

1. Power Purchase Agreements (PPAs) and Electricity Rates

A long-term PPA is the cornerstone of profitability. This contract locks in a fixed price for the electricity you sell to the utility grid, providing revenue certainty for 15-25 years. Regions with high wholesale electricity prices will naturally yield higher returns. The stability of a PPA significantly de-risks the investment compared to relying on volatile spot market prices.

2. Geographic Location and Solar Resource

The amount of sunlight your location receives directly impacts energy production. A solar farm in sun-rich regions like the Southwest US, Australia, or the Middle East will generate significantly more electricity—and thus more revenue—than one in a less sunny climate. Tools like NASA's solar irradiance data can help quantify this potential during the site selection phase.

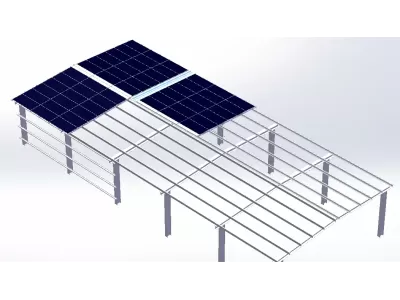

3. Technology and System Efficiency

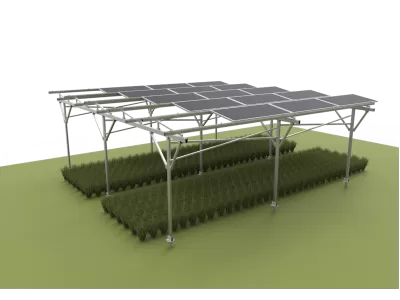

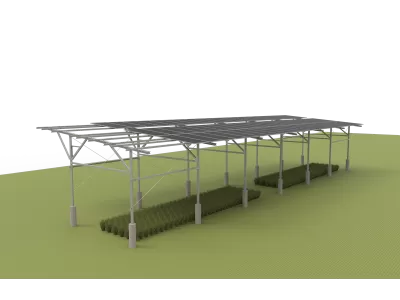

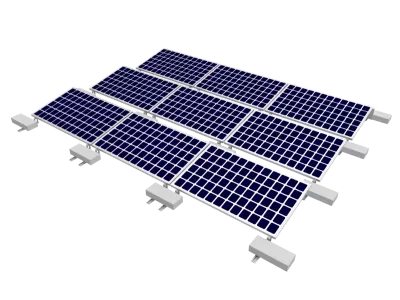

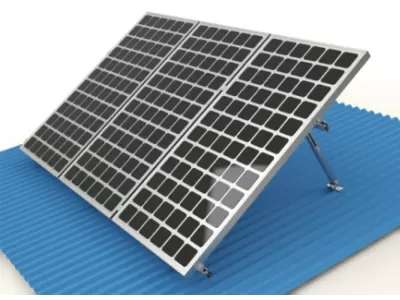

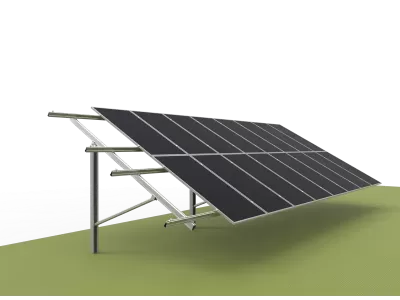

Your choice of components critically affects output and maintenance costs. High-efficiency panels and advanced mounting systems are crucial. For instance, using a flat type farm mounting system on ideal terrain or a slope type aluminum solar mounting system for uneven land ensures optimal panel orientation and durability. Advanced solutions like the GS-Light intelligent tracking system can increase energy yield by up to 25% compared to fixed systems, directly boosting revenue.

4. Government Incentives and Land Costs

Tax credits, grants, and accelerated depreciation can reduce your upfront cost by 30% or more. Additionally, securing affordable land, whether through purchase or lease, is a major factor in improving ROI. Projects developed on low-value, repurposed, or agrivoltaic-friendly land often see the best financial returns while minimizing community opposition.

Maximizing Profitability with Grace Solar's Expertise

Profitability isn't just about the numbers; it's about the execution. With over 48GW of global project experience, Grace Solar understands how to engineer projects for maximum financial return. Our expertise ensures that your investment is optimized from day one.

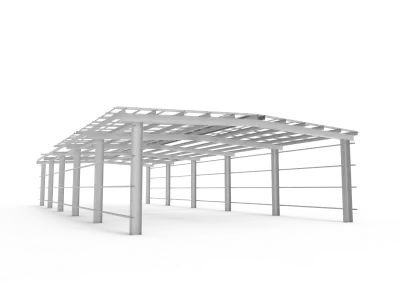

Our solar EPC solutions ensure that every project is built to the highest standards, on time and within budget. We leverage our top-tier solar mounting components & accessories to create durable, low-maintenance structures that withstand harsh environments, minimizing operational costs over the farm's 25+ year lifespan. This commitment to quality directly protects your ROI.

Utility-Scale vs. Community Solar: Which is More Profitable?

The profitability model differs based on the project type. Understanding these differences is key to choosing the right investment for your goals.

- Utility-Scale Solar Farms (1MW+): Require significant capital but benefit from economies of scale, leading to a lower cost per watt and stable, long-term revenue through PPAs. These are ideal for institutional investors seeking predictable, long-term yields.

- Community Solar Farms (Under 5MW): Offer a lower entry point for investors and generate revenue by selling shares or subscriptions to local residents or businesses. This model can be highly profitable in regions with supportive virtual net metering policies and high retail electricity rates, appealing to local communities and individual investors.

Managing Risks and Ensuring Long-Term Profitability

Like any investment, solar farms carry risks that must be managed. A well-structured plan accounts for the following:

- Grid Connection Delays: Securing interconnection approval can be a lengthy process. Early engagement with grid operators is critical.

- Equipment Performance: Choosing high-quality, bankable equipment with strong warranties mitigates the risk of underperformance. Grace Solar's systems are designed for reliability and backed by comprehensive certifications.

- Regulatory Changes: While incentives are stable, staying informed about potential policy shifts is part of sound management.

- Operations and Maintenance (O&M): A proactive O&M plan, including regular cleaning and monitoring, is essential to maintain peak energy production throughout the project's life.

Conclusion: A Sun-Powered Investment for the Long Term

Owning a solar farm is a proven and profitable venture. While the initial investment is substantial, the combination of predictable long-term revenue, low operating costs, and strong government support creates an attractive ROI profile. The key to unlocking maximum profitability lies in precise planning, high-quality engineering, and reliable technology.

By choosing a partner like Grace Solar, you gain access to world-class solar solutions and engineering expertise that ensure your project is built for performance and durability. Ready to calculate the potential profit for your solar farm project? Contact us today for a personalized feasibility analysis.